Stock Name: Xinzhongde Stock Code: 430683

Polyethylene: Prices Drop 1,000 RMB/ton This Week! Could the Situation Get Even Worse?

发布时间:2022-03-29

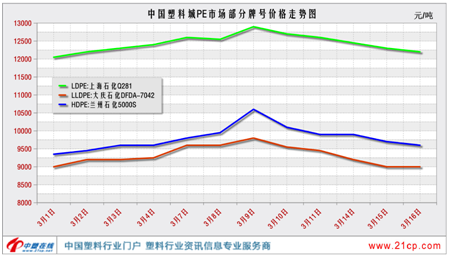

At the beginning of the month, the mountains and rivers basked in the lingering warmth of late spring, while gentle breezes carried the fragrant scents of flowers and grasses. The sharp rise in polyethylene prices can be attributed to the dramatic surge in international crude oil prices—like a single stone tossed into calm waters, it sent ripples spreading far and wide. Soon after, monomers, overseas markets, futures, and petrochemical producers all followed suit, pushing market sentiment to an exhilarating peak. But by mid-month, as spring dreams gave way to waking awareness, sorrowful cries began echoing everywhere. As crude oil prices swiftly reversed course and plummeted, polyethylene markets showed no sign of resistance, plunging straight downward—and panic quickly gripped traders at China Plastics City. By the 16th, Shanghai Petrochemical’s Q281 grade had already dropped by 700 yuan/ton from its earlier high, while Daqing Petrochemical’s 7042 grade fell by 800 yuan/ton, and Lanzhou Petrochemical’s 5000S grade tumbled by as much as 1,000 yuan/ton from its peak. Yet, excessive worry won’t alter the reality—after all, every rise and fall has its underlying causes. So let’s start with the upstream players and dissect the situation piece by piece.

Figure 1: Trend Chart of Selected PE Prices at China Plastics City Market in March

Upstream: If it weren’t for disruptions in upstream raw materials, the pace at which polyethylene prices have fallen wouldn’t have been so rapid. Meanwhile, soaring global inflation, coupled with the escalating Russia-Ukraine conflict, has intensified concerns over energy market supply shortages. As a result, international oil prices hit fresh 2008-era highs—on March 7, WTI crude briefly surged to an intraday peak of $133.46 per barrel, while May Brent crude futures climbed as high as $139 per barrel. However, as signs of easing tensions between Russia and Ukraine emerged, positive developments in Iran nuclear talks gained momentum, and the UAE signaled its intention to boost production, combined with expectations that the Federal Reserve may soon raise interest rates, international oil prices began a sharp downward swing from their earlier peaks. By March 15, WTI settled at $96.44 per barrel, and Brent closed at $99.91—a significant drop that weakened cost-based support for the market. In response, the spot polyethylene market quickly adjusted, plunging across the board.

Futures: Crude oil prices have recently plunged, pushing the market into a predominantly bearish mood. The main linear futures contract settled at 9,673 yuan on the 9th, but by the 16th, the settlement price had already dropped to 8,823 yuan. Given the current high volatility in crude oil markets, risks remain elevated, and in the short term, price movements will likely continue to align primarily with cost fluctuations.

Also, prices, market, USD, polyethylene, petrochemicals, settlement price, futures, crude oil, and decline